Risk Management for Account Executives

Course Description

In order to attract and retain customers in the emerging competitive power market, Account Executives will need to be familiar with basic risk management techniques. Because customers have different objectives that they are trying to accomplish with respect to price, it may be more appropriate to custom tailor risk management programs to meet customer needs rather than to engage in risk management techniques at the utility level. Large customers in particular may be able to derive significant benefits by employing risk management techniques themselves. Risk management techniques such as futures, hedging, options, swaps, exchange of futures for physicals (EFP), floors, caps and collars will be explained with practical examples of their use. The methods for fixing a floating rate, for floating a fixed rate and for reducing price variability will be discussed as well as how these techniques might be usefully applied to achieve customer objectives. Practical exercises will be used to aid the learning process. This course is designed as a two day course for up to 25 students and would be taught by two instructors.

Learning Objectives

After this course students will be able to:

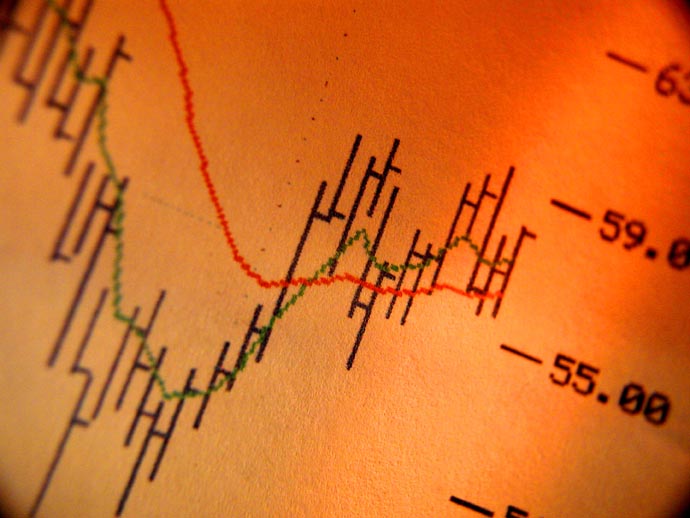

- Describe basic risk management techniques, such as futures, hedging, options, swaps, exchange of futures for physicals (EFP), floors, caps and collars.

- Explain the use of risk management techniques to customers.

- Listen to customers, identify their objectives in the pricing area and identify the risk management techniques that could be used to achieve these objectives.

- Work with utility’s risk managers in designing a risk management program to achieve customer objectives.

Course Outline

1. Introduction

A. What is Risk Management?

B. Objectives of Risk Management

C. Why use Risk Management tools for mitigating risk?

2. Risk Management Techniques

A. Gas and Electric Futures

B. Hedging

C. Future spreads

D. Options

E. Swaps

F. Exchange of futures for physicals (EFP)

G. Floors, caps and collars

H. Forward pricing curves

3. Practical Applications in the Electric Utility Industry

A. Basic hedging

B. Interruptible service and risk management techniques

C. Using risk management to meet the needs of electric customers

4. Practical Applications in the Gas Utility Industry

A. Basic hedging

B. Pipeline storage and risk management techniques

C. Curtailable service and risk management techniques

D. Using risk management to meet the needs of gas customers

5. Identifying opportunities for Risk Management